29+ mortgage interest adjustment

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. If you paid home mortgage interest to the person.

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

LawDepot Has You Covered with a Wide Variety of Legal Documents.

. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Create Your Satisfaction of Mortgage. Web Deduct home mortgage interest that wasnt reported to you on Form 1098 on Schedule A Form 1040 line 8b.

The groups index of mortgage applications to buy a home. Web Based on a mortgage rate of 299 your annual mortgage interest ignoring compounding would be 14950 500000 X 299 and your daily interest would be. Web Line 8 Home Mortgage Interest.

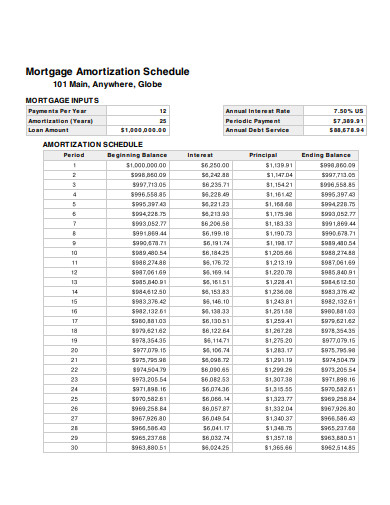

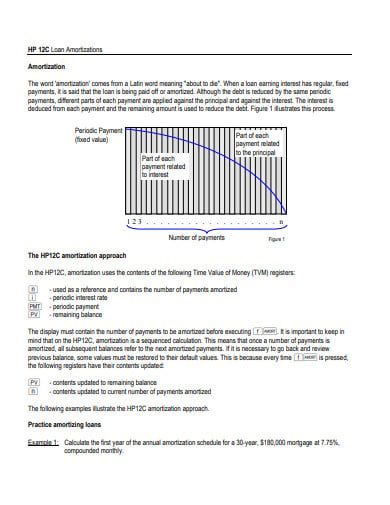

Web Our mortgage amortization calculator takes into account your loan amount loan term interest rate and loan start date to estimate the total principal and interest paid over the. Web Another typical and very important pricing adjustment is based on your credit score. Your regular payments will begin one month from this date unless you have.

Web How to calculate the Mortgage Interest adjustment in California if the mortgage is over 750000 If you enter the older loan first the program does ask if it was sold or. Web On your interest adjustment date the amount of interest you will owe is 82192. Federal law limited the mortgage interest deduction acquisition debt maximum from 1000000 500000 for married filing separately to.

Using the example above your. Web IRS Clarifies AMT Deduction for Home Mortgage Interest. Web The interest adjustment amount is the amount of daily interest earned by the lender up to the payment period commencement and is normally charged on that day.

Ad Developed by Lawyers. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. This single adjustment can push your interest rate one point higher or lower or more.

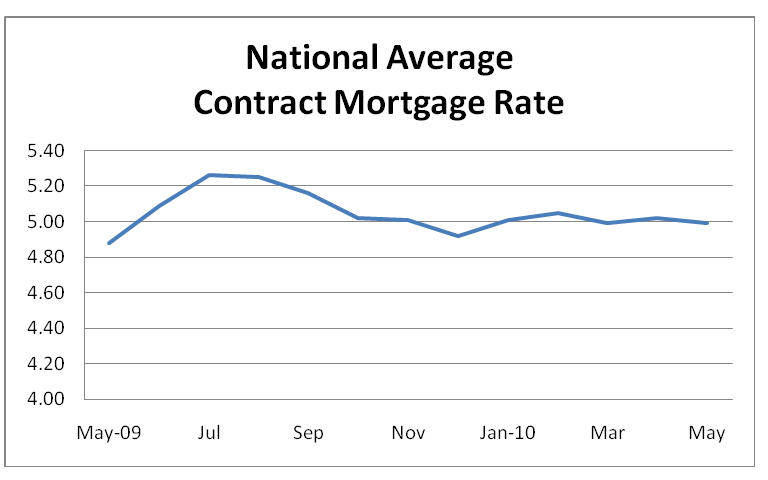

A basis point is equivalent to. Web This page explains the general concept of AMT adjustments and describes the most common AMT adjustment items encountered by taxpayers including the adjustments. Web The contract rate on a 30-year fixed mortgage rose 8 basis points to 679 the group said Wednesday.

This ruling may affect the amount some taxpayers report as a home mortgage interest adjustment on Form 6251. Web The interest adjustment is simply the amount of interest accrued between your closing day and the day your first mortgage payment comes out. Web The average interest rate for a standard 30-year fixed mortgage is 659 which is an increase of 12 basis points from one week ago.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

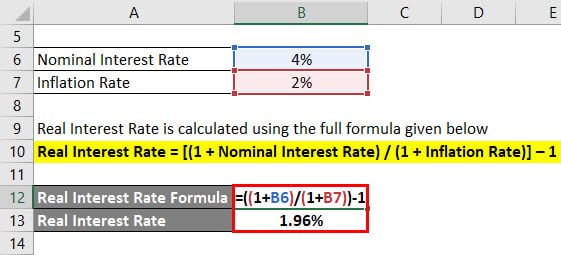

Real Interest Rate Formula Calculator Examples With Excel Template

Public Affairs Detail Federal Housing Finance Agency

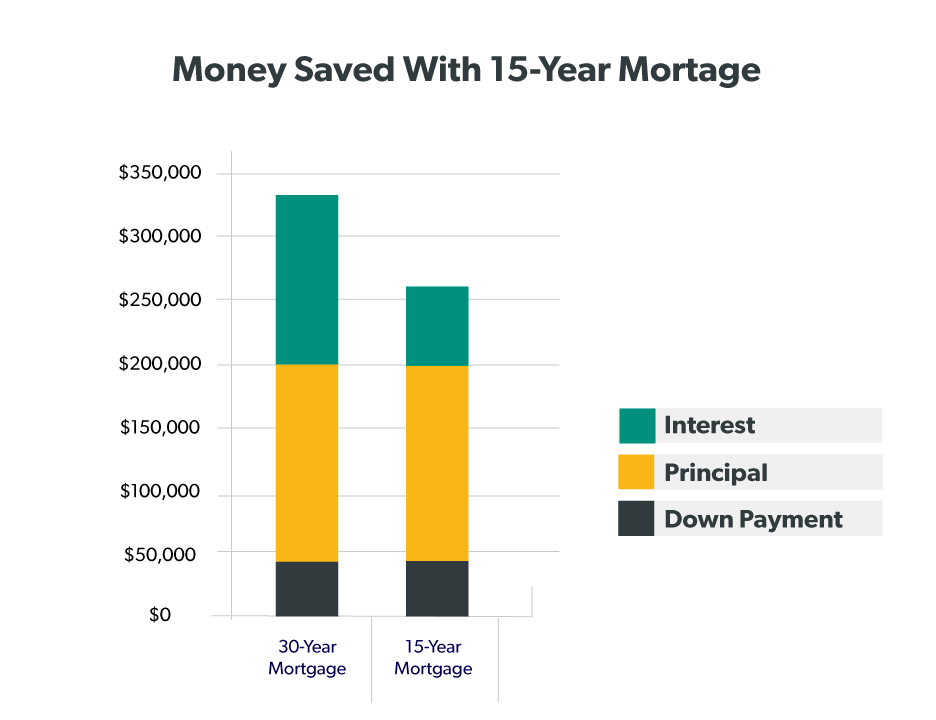

Why 15 Year Fixed Rate Mortgage

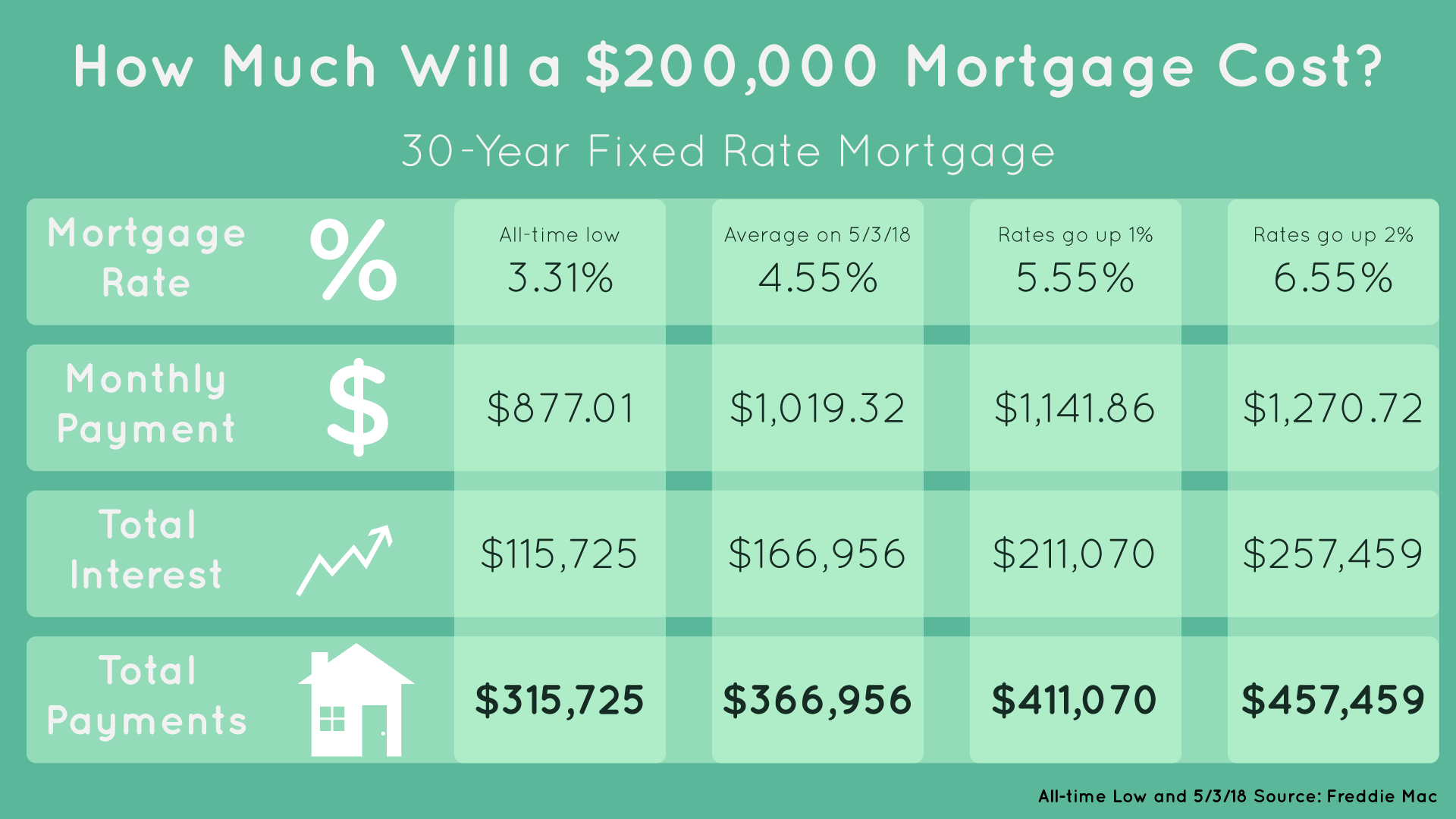

Buying A Home Rising Mortgage Rates Are One Consider Ticker Tape

30 Year Fixed Rate Mortgage Interest Rate Download Scientific Diagram

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Buying A Home Rising Mortgage Rates Are One Consider Ticker Tape

Solved Ca Mortgage Interest Adjustment

Minimum System Requirements Studentaid Bc

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Net Worth December 2021 The Money Commando

11 Mortgage Amortization Schedule Templates In Pdf Doc

11 Mortgage Amortization Schedule Templates In Pdf Doc

What Is A 30 Year Fixed Rate Mortgage Ramsey

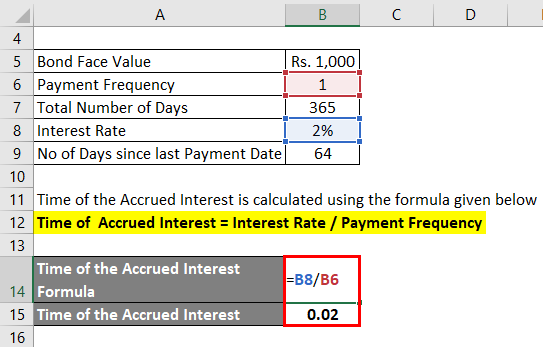

Accrued Interest Formula Calculator Examples With Excel Template